Carbon neutral shipments in Europe

After one customer asked to me about sustainability and what measures we are taking to reduce impact on environment, i decided to write an article explaining how Spainbox and how couriers like UPS, Fedex and Correos Express have a compromise or help to reduce impact on environment reducing carbon dioxide emissions. Couriers are trying to […]

Ecommerce 3PL Warehouse management processes to optimize your online sales

If your company sells products, you’ll need a place to keep them. Most often, this is in a fulfillment center, distribution center, or warehouse. You can acquire land, lease a building, recruit employees, buy equipment, and convince clients to buy from you, but that’s not all. The success of a company is determined on how […]

Delivery: How To Deal With Customers Who Are More Demanding Than Ever?

Demanding customers are never satisfied with anything and always want more. No matter how annoying they are, you have no choice but to talk to them politely and keep a constant smile on the face. If you think deeply, these demanding customers increase your expertise in the business because they are just like risks, which […]

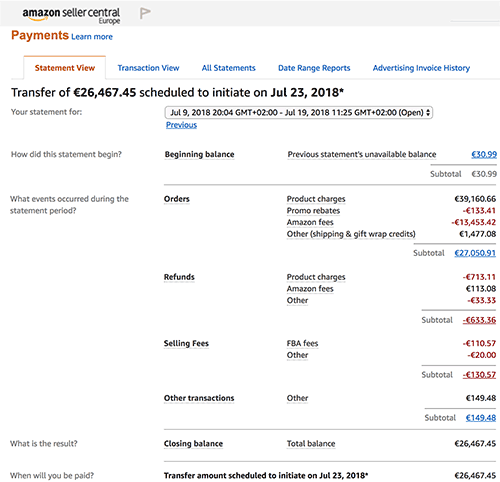

Comprehensive List of Amazon Seller Fees

If you are looking to sell on Amazon, you would have to take into account the different seller fees to ensure you aren’t in the red. Sure it can take a while to understand the most complex fees calculation that Amazon has, but if you know the different seller fees, you won’t have to worry. […]

The Top list of Amazon seller fees You Need to Know

Here are the top Amazon seller fees you would need to take care. 1. Amazon sale related transaction fees: As a seller, you have to pay three different fees. i) Referral Fee, ii). Minimum Referral Fee, iii) Variable Closing Fee. Referral Fee Amazon puts referral fee on every product it sells. Depending on the product […]

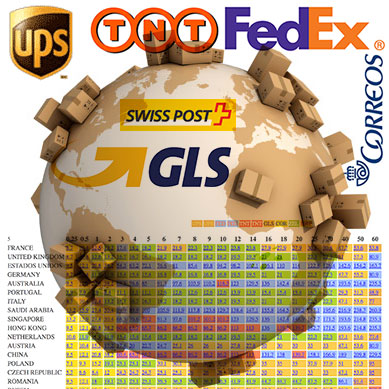

Cheap International Courier Services from Spain

International Parcel Delivery We have created a table of the most frequent destination countries with the cheapest shipping table rates from 0.5kg to 60 kgs. Nice to know: All of our worldwide courier services are provided by UPS, FEDEX, TNT, GLS, Correos, Zeleris, Swiss Post You can upgrade to as much as 1,000 euros loss/damage cover when you book your collection. […]

Compare Multichannel Sales & Inventory management software for sucessfull online sellers in Spain

In this article, I have checked all features of Multichannel sales and inventory management software in Spain for successful sellers that have thousands of orders by month and don’t want to waste hundreds of US dollars in a software solution. This study is not only for Spain is for any marketplace, it means that software providers […]

Register a VAT number in Spain and get an EORI to allow to import in Spain, Germany, France, Italy and return taxes quarterly for distance sales in Europe for 99€/mo

Amazon sellers that need to import in Spain or any other marketplace in Europe like Amazon UK, Amazon Germany, Amazon France or Amazon Italy, its required to have his own VAT number and Associated EORI in the country where they are going to be imported. Register a new VAT number in Spain, Italy or France […]

How to Integrate your shopping cart with an Outsourced order Fulfillment warehouse

For online sellers, accurate and efficient order fulfillments is very important to have a solid integration between the Web shop and the Warehouse management system (the software at the warehouse that manages stock and orders). Sending electronically orders info to the particular warehouse personnel not only removes manual purchase entry mistakes but additionally really helps […]

Cross Docking in Spain: Postal Mail and Courier Services

What is Cross Docking? Cross Docking is a logistics procedure where products from a seller are distributed directly to their customer with no handling or storage costs. It means that the seller can consolidate all the orders from a determined country in one parcel and send it to a cross docking center located in this country. […]